Open a live account and start trading in just minutes.

This site uses cookies to provide you with a great user experience. By visiting haythamfx.com, you accept our cookie policy.

Allow allThis site uses cookies to provide you with a great user experience. By visiting haythamfx.com, you accept our cookie policy.

Allow allTrade 15 of the most liquid and heavily traded global commodities and uncover endless opportunities across key market cycles and seasonal trends.

With HaythamFX, you can trade CFDs on physical commodities like Oil, Gold, Gas, Coffee, Orange Juice, and more—directly from your platform!

Start trading commodities with confidence today!

| Platform Symbol |

Type | Market | Size/ volume |

USD value/ per tick |

E.g for tick value per tick |

1%Margin | Currency | Max. Leverage |

Min. volume |

Max. volume |

|---|---|---|---|---|---|---|---|---|---|---|

|

CL-OIL

|

CFD Oil |

Nymex/ CME |

0.01 = 10 barrels |

USD$0.10 |

99.56 → 99.57 |

1% x (10 x market price) |

USD |

333:1 |

0.01 |

20 |

|

NG

|

CFD Natural Gas |

Nymex/ CME |

0.01 = = 100 MMBtu |

USD$0.1 |

1.935 → 1.936 |

1% x (100 MMBtu x price per MMBtu) |

USD |

20:1 |

0.10 |

20 |

|

Gas

|

CFD Gasoline |

Nymex/ CME |

0.01 = = 420 Gallon |

USD$0.042 |

1.0158 → 1.0159 |

1% x (420 Gallon x price per gallon) |

USD |

20:1 |

0.01 |

20 |

|

GASOIL-C

|

CFD Gasoil |

Nymex/ CME |

0.01 = 10 Metric Tonnes |

USD$0.1 |

458.24 → 458.25 |

1% x (10 Metric Tonnes x price per metric tonnes) |

USD |

100:1 |

0.1 |

20 |

|

USOUSD

|

CFD Cash |

Market Cash |

0.01 = 10 Barrels |

USD$0.10 |

50.00 → 50.01 |

1% x (10 x Market price) |

USD |

333:1 |

0.01 |

20 |

|

UKOUSD

|

CFD Cash |

Market Cash |

1 |

USD$0.001 |

65.731 → 65.732 |

1% x (10 x Market price) |

USD |

333:1 |

0.01 |

20 |

| Platform Symbol |

Type | Market | Size/ volume |

USD value/ per tick |

E.g for tick value per tick |

1%Margin | Currency | Max. Leverage |

Min. volume |

Max. volume |

|---|---|---|---|---|---|---|---|---|---|---|

|

Forex Gold |

FX Spot |

0.01 = 1 oz |

USD$0.01 |

1070.60-> 1070.61 |

1% x (100 oz x price per oz) |

USD |

1000:1 |

0.01 |

50 |

|

|

Forex Silver |

FX Spot |

0.01 = 50 oz |

USD$0.50 |

12.52-> 12.53 |

1% x (50 oz x price per oz) |

USD |

100:1 |

0.01 |

20 |

|

Forex Gold |

FX Spot |

0.01 = 1 oz |

USD$0.01 |

1070.60-> 1070.61 |

1% x (100 oz x price per oz) |

AUD |

1000:1 |

0.01 |

50 |

|

|

Forex Silver |

FX Spot |

0.01 = 50 oz |

USD$0.50 |

12.52-> 12.53 |

1% x (50 oz x price per oz) |

AUD |

100:1 |

0.01 |

20 |

|

|

Copper |

Nymex/ CME |

0.01 = 250 lbs |

USD$0.025 |

2.0655-> 2.0656 |

1% x (250 lbs x price per lbs) |

USD |

20:1 |

0.01 |

10 |

| Platform Symbol |

Type | Market | Size/ volume |

USD value/ per tick |

E.g for tick value per tick |

1%Margin | Currency | Max. Leverage |

Min. volume |

Max. volume |

|---|---|---|---|---|---|---|---|---|---|---|

|

Cocoa-C

|

Soft Commodity |

Nymex/ CME |

0.1=1 Metric Tons |

USD$0.1 |

1928.5-> 11928.6 |

2% x (1 Tons x price per Ton) |

USD |

50:1 |

0.1 |

20 |

|

Coffee-C

|

Soft Commodity |

Nymex/ CME |

0.1=3,750 Pounds |

USD$0.375 |

1.3340-> 1.3341 |

2% x (3,750 Pound x price per Pound) |

USD |

50:1 |

0.1 |

20 |

Cotton-C

|

Soft Commodity |

Nymex/ CME |

0.1=5,000 Pounds |

USD$0.05 |

0.72152-> 0.72153 |

3% x (5,000 Pound x price per Pound) |

USD |

33:1 |

0.1 |

20 |

|

Orange-C

|

Soft Commodity |

Nymex/ CME |

0.1=1,500 Pounds |

USD$0.15 |

1.2977-> 1.2978 |

3% x (1,500 Pound x price per Pound) |

USD |

33:1 |

0.1 |

20 |

|

Sugar-C

|

Soft Commodity |

Nymex/ CME |

0.1=11,200 Pounds |

USD$1.12 |

0.1443-> 0.1444 |

3% x (11,200 Pound x price per Pound) |

USD |

33:1 |

0.1 |

20 |

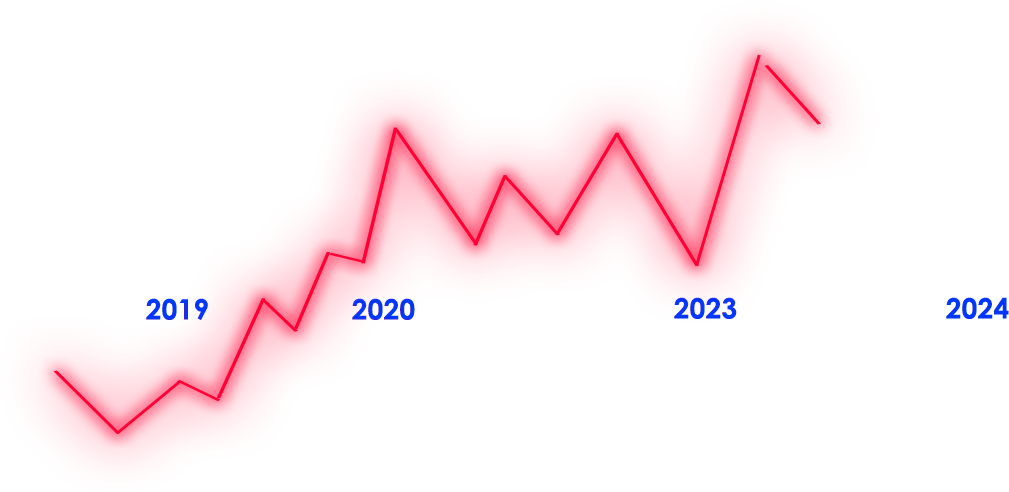

Gold

Gold breaks out of a multi-year consolidation range, signaling what could be the beginning of a massive upward trend.

Covid

Fueled by post-COVID recession fears, gold initially struggled near resistance, but the longer-term view remains bullish.

Global Conflict

After years of stagnation due to global crises, gold finally breaks free and resumes its powerful uptrend into uncharted territory.

What’s next?

What could spark the next major shift in commodities?

Be ready for the next explosive move—bullish or bearish!

Open a live account and start trading in just minutes.

Fund your account using a wide range of funding methods.

Access 1000+ instruments across all asset classes